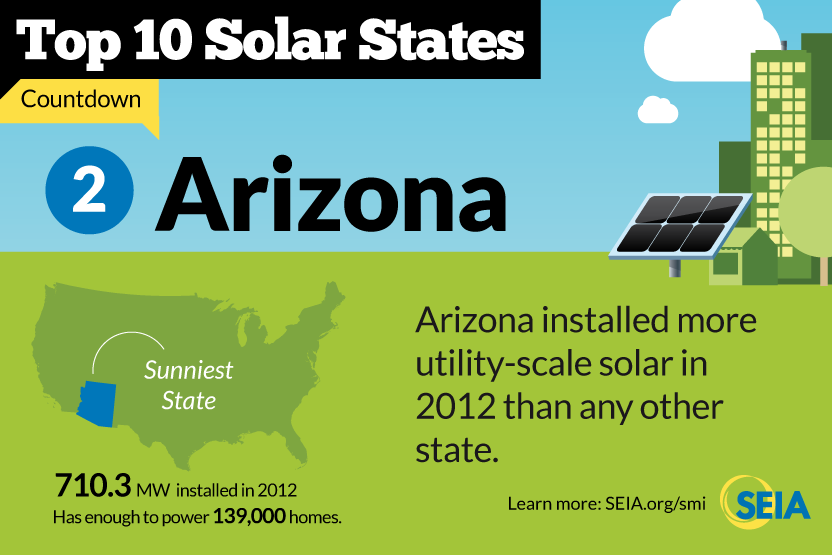

State Of Arizona Energy Rebates. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces. Energy efficiency and electrification rebates.

An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces. Renewable energy production tax credit.

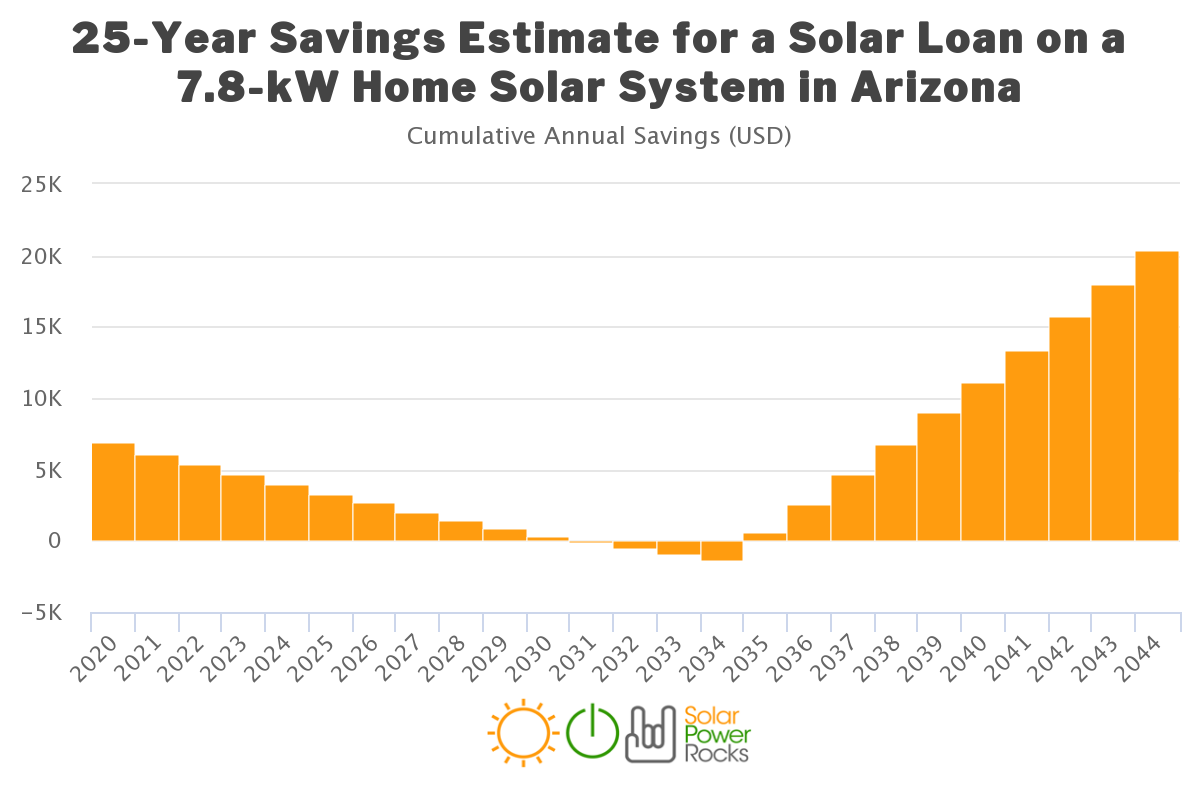

Assuming That Your Solar Energy System Costs $20,000, You Would.

States report outcomes of state energy program and weatherization assistance program formula (annual) fund activities to doe on a quarterly basis.

The Rebate Is Based On The Size Of The System And Is.

Residents of arizona can capitalize on various financial incentives, including a statewide tax credit, tax exemptions, and local rebate programs, in addition to the 30% federal solar.

There Are Several Arizona Solar Tax Credits And Exemptions That Can Help You Go Solar:

Images References :

Source: www.rgrmarketing.com

Source: www.rgrmarketing.com

Solar Incentives for Arizona Residents Tax Rebates for Solar Energy, There are several arizona solar tax credits and exemptions that can help you go solar: Inflation reduction act tax credits in arizona.

Source: www.altestore.com

Source: www.altestore.com

Solar Rebates & Renewable Energy Incentives for Arizona altE, Federal tax credits for arizona residents. Tax credits and rebates are available to property owners who upgrade or maintain renewable energy sources.

Source: printablerebateform.net

Source: printablerebateform.net

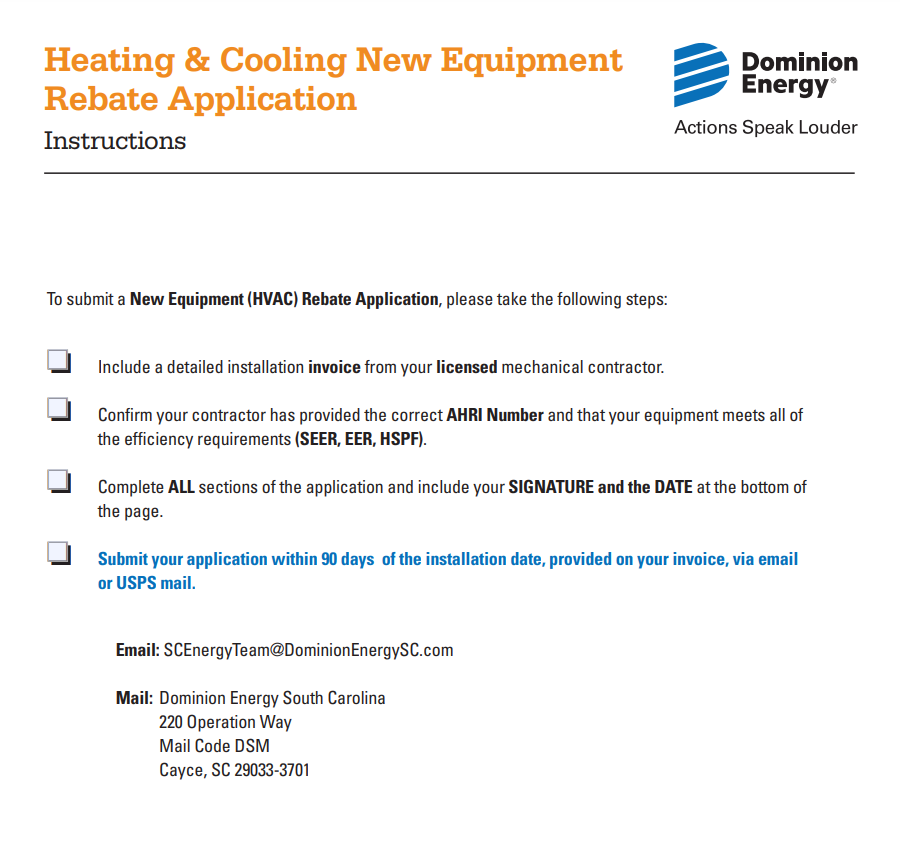

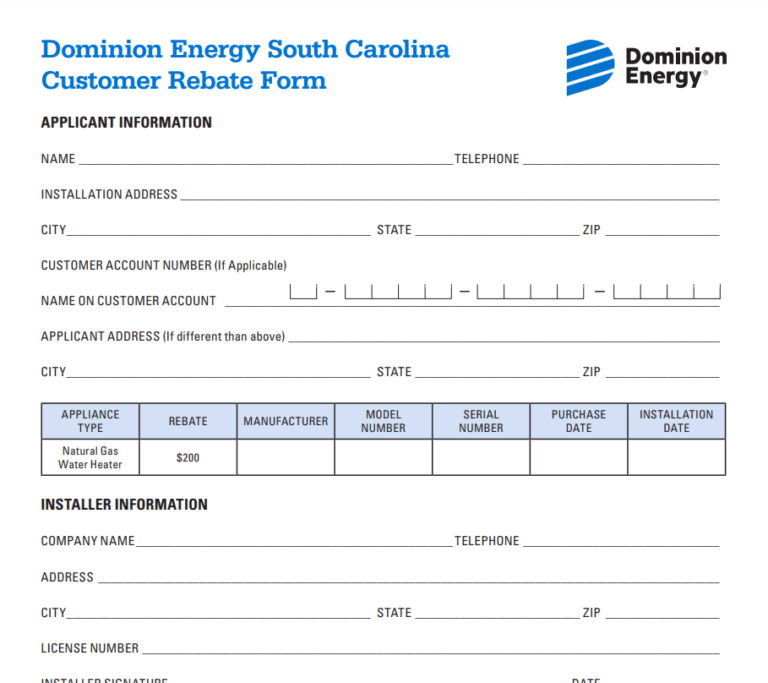

Dominion Energy Rebate Form By State Printable Rebate Form, The state of arizona offers a rebate to residents and businesses that install solar energy systems. Starting in 2023, you can claim up to 30% (a maximum of $1,200 each year) for energy upgrades like adding insulation or swapping.

Source: printablerebateform.net

Source: printablerebateform.net

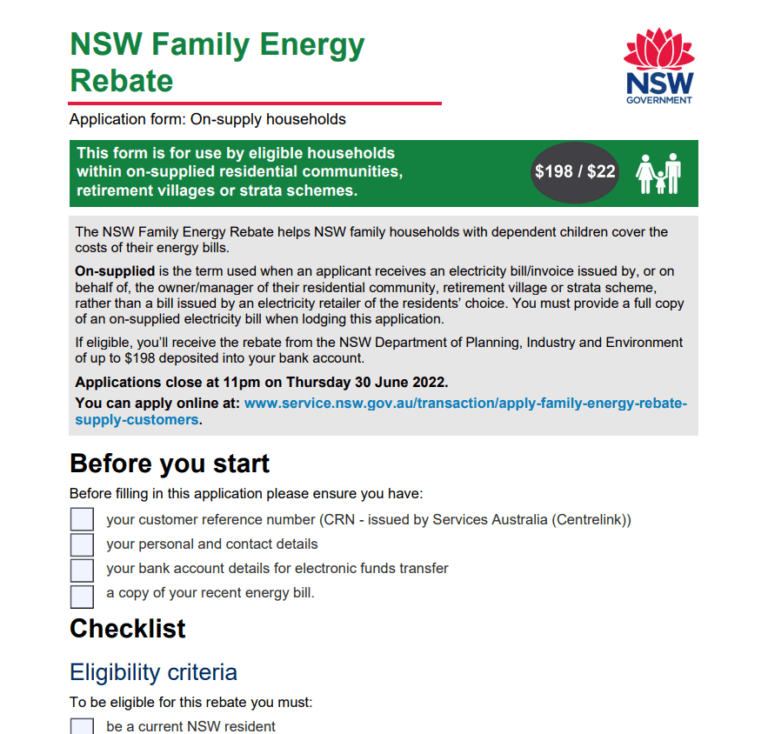

Energy Rebate Form 2022 Air Conditioner Printable Rebate Form, This means 30% off the system's total cost, including equipment, labor, and permitting. Tax credits and rebates are available to property owners who upgrade or maintain renewable energy sources.

Source: printablerebateform.net

Source: printablerebateform.net

Dominion Energy Rebate Form 2023, Tax credits and rebates are available to property owners who upgrade or maintain renewable energy sources. The inflation reduction act passed in august 2022 extended and added some important tax credits for qualifying improvements made on or after jan.

Source: printablerebateform.net

Source: printablerebateform.net

Alliant Energy Rebates 2022 Printable Rebate Form, Residential solar energy tax credit; Three ways to tap into tax credits to go green and save green!

Source: www.youtube.com

Source: www.youtube.com

APS Solar Rebate Arizona Phoenix Solar Rebate APS YouTube, Starting in 2023, you can claim up to 30% (a maximum of $1,200 each year) for energy upgrades like adding insulation or swapping. Tax credits and rebates are available to property owners who upgrade or maintain renewable energy sources.

Source: printablerebateform.net

Source: printablerebateform.net

Xcel Energy Rebate Form By State Printable Rebate Form, One such program is arizona’s energy equipment property. There are several arizona solar tax credits and exemptions that can help you go solar:

Source: schmidt-arch.com

Source: schmidt-arch.com

Energy Rebates Don't Leave Money on the Table Schmidt Associates, Residential solar energy tax credit: Click on a state to see a list of utility companies with active.

Source: www.azenergyefficienthome.com

Source: www.azenergyefficienthome.com

Energy Improvement Rebates Phoenix Energy Audit Company APS Rebate, The inflation reduction act passed in august 2022 extended and added some important tax credits for qualifying improvements made on or after jan. If you’ve ever thought about looking into an electric vehicle, going solar or cutting energy costs, 2023.

There Are Several Arizona Solar Tax Credits And Exemptions That Can Help You Go Solar:

Federal tax credits for arizona residents.

Az Energy Efficient Home Will Execute The Rebate Process From Energy Audit To Retrofit Repairs That Are Needed, To The Facilitation And Submission Of.

States report outcomes of state energy program and weatherization assistance program formula (annual) fund activities to doe on a quarterly basis.