Medicare Tax Limit 2024 For High Earners. The standard part b premium is $174.70 in 2024. Washington (ap) — former president donald trump’s new proposal to exclude tips from federal taxes is getting.

The 2024 medicare tax rate remains at 1.45% for both employees and employers totaling 2.9%, as it was in 2023. The additional medicare tax is an extra 0.9% on earned income beyond a specific threshold limit.

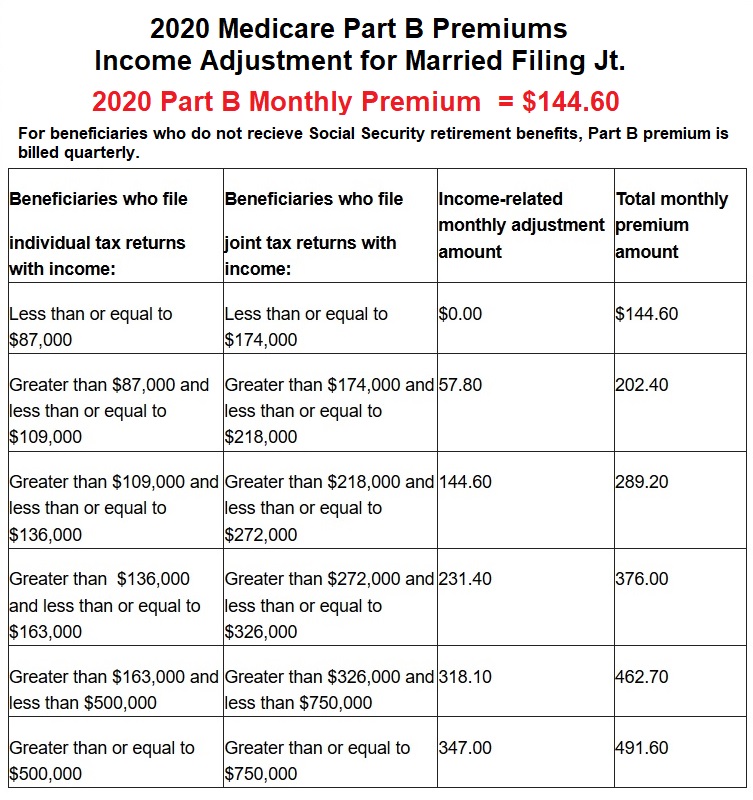

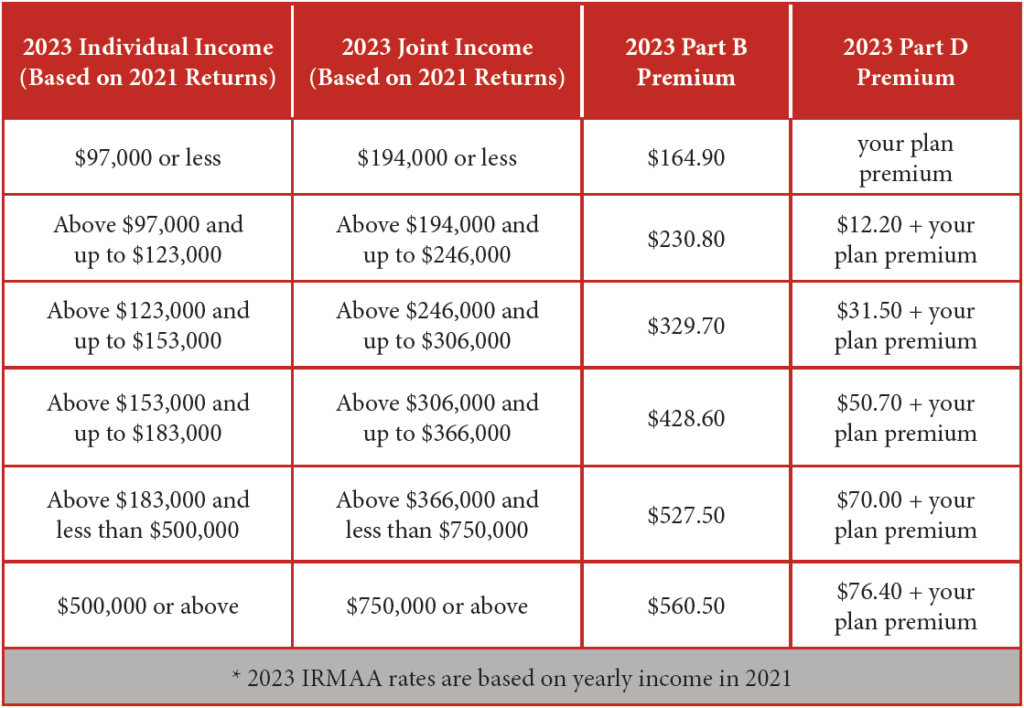

Irmaa Is A Surcharge That People With Income Above A Certain Amount Must Pay In Addition To Their Medicare Part B And Part D Premiums.

The income brackets are the same.

There Is No Maximum Wage Limit For The.

For 2024, the medicare surtax thresholds are set to impact single filers with an adjusted gross income (agi) above $200,000 and married couples filing jointly with an agi.

It’s A Mandatory Payroll Tax.

Images References :

Source: ranicewmindy.pages.dev

Source: ranicewmindy.pages.dev

Medicare Tax Limits 2024 Meryl Suellen, The tax cuts and jobs act, trump’s 2017 law, lowered rates for individuals of almost all income levels, though it cut taxes most for the highest earners, and slashed. Finance minister nirmala sitharaman is likely to present union budget 2024 this month.

Source: traceewdahlia.pages.dev

Source: traceewdahlia.pages.dev

Medicare Premiums For High Earners 2024 Terra, To aid in this effort, the aca added an additional medicare tax for high income earners. The standard part b premium for 2024 is $174.70.

Source: marie-annwcally.pages.dev

Source: marie-annwcally.pages.dev

Medicare Savings Program Limits 2024 Kath Sarita, On october 12, 2023, the centers for medicare & medicaid services (cms) released the 2024 premiums, deductibles, and coinsurance amounts for the medicare part a and part. New tax regime may see higher deduction limit.

Source: traceewdahlia.pages.dev

Source: traceewdahlia.pages.dev

Medicare Premiums For High Earners 2024 Terra, The income brackets are the same. For example, you must pay a 6.2% social security tax for the first $168,600 as of 2024.

Medicare Tax Limits 2024 Jodi Rosene, The tax rate is an extra 0.9%. Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d premiums.

Source: ireneqoralla.pages.dev

Source: ireneqoralla.pages.dev

Medicare Tax Calculator 2024 Myrah Tiphany, Even though most people by that age have stopped working and make less money than in their prime earning years, an rmd from an ira or. Washington (ap) — former president donald trump’s new proposal to exclude tips from federal taxes is getting.

Medicaid Limit 2024 Ohio Clara Freddie, The tax rate is an extra 0.9%. Standard deduction increase expected in budget 2024.

Source: shandeewidalia.pages.dev

Source: shandeewidalia.pages.dev

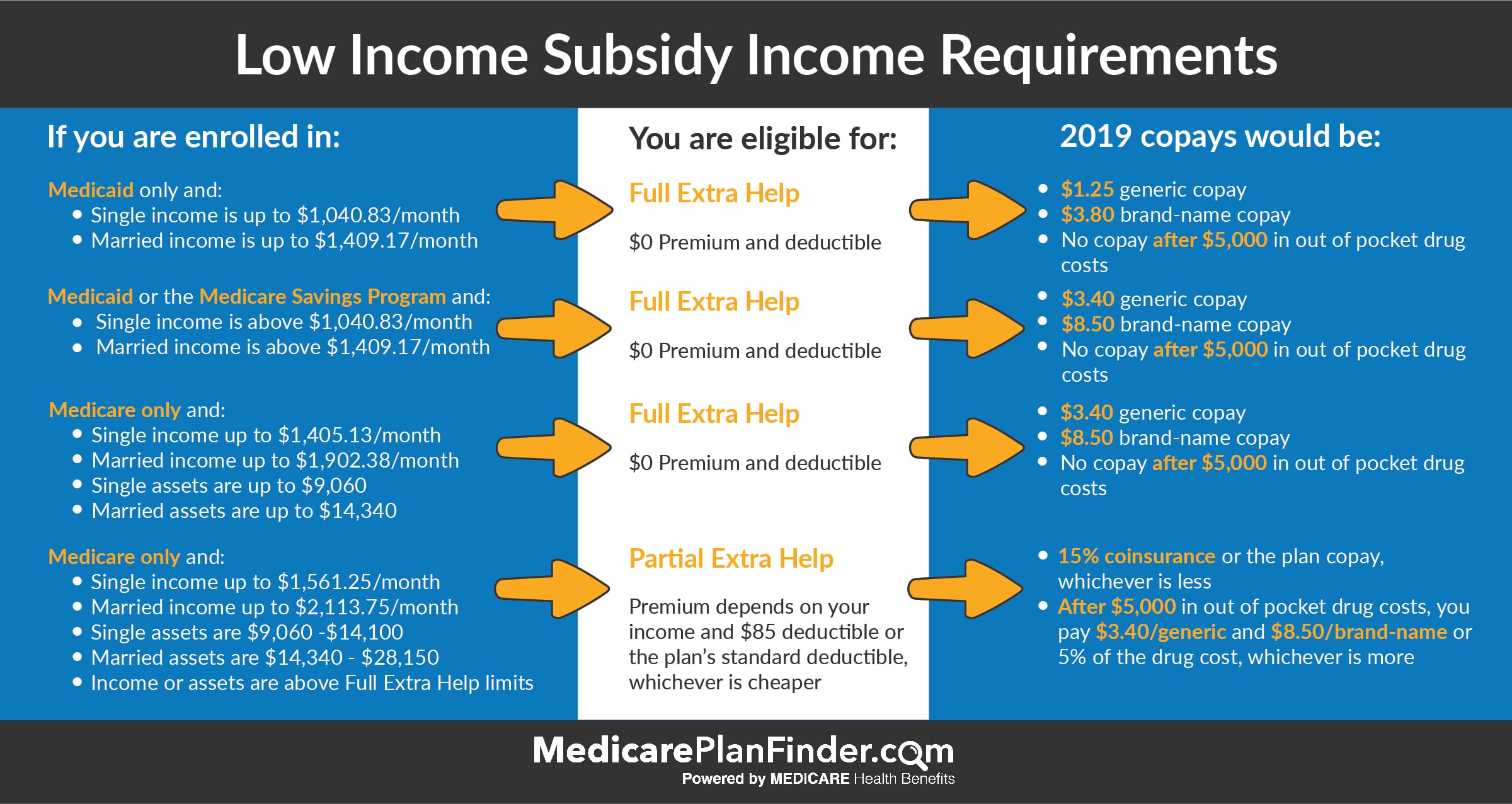

Extra Help Limits 2024 Clem Melita, In 2024, this threshold is $200,000 for individuals and. Washington (ap) — former president donald trump’s new proposal to exclude tips from federal taxes is getting.

Source: livvyqlynelle.pages.dev

Source: livvyqlynelle.pages.dev

Hsa Limits 2024 Rycca Clemence, Plus, 1.45% medicare tax on unlimited income. For the 2024 tax year, those levels are:

Source: meggiewtildi.pages.dev

Source: meggiewtildi.pages.dev

Medicare Irmaa 2024 Brackets And Premiums Tani Quentin, It’s a mandatory payroll tax. The percentage of medicare tax was raised from 1.45 percent to 2.34.

On October 12, 2023, The Centers For Medicare &Amp; Medicaid Services (Cms) Released The 2024 Premiums, Deductibles, And Coinsurance Amounts For The Medicare Part A And Part.

Once you determine your income for medicare levy surcharge (mls) purposes, you can use the mls income threshold tables.

Biden Will Seek To Raise Medicare Tax On High Earners And Push For More Drug Price Negotiations To Help Keep The Federal Health Insurance Program Solvent Through At.

For the 2024 tax year, those levels are: